Processing invoices manually is manageable in the early stages of a business. But as you start to scale, using spreadsheets and other manual methods just isn’t practical in the long run.

Manual processes can lead to issues like missing invoices, delayed payments, and even instances of fraud — all of which can hurt your bottom line and damage relationships with your vendors.

So how can you manage your invoices better and prevent costly errors? And how can you increase visibility across the entire accounts payable process?

By implementing an automated invoice processing solution.

In this article, we’ll look at what automated invoice processing is and how it can help you improve invoice management. We’ll also cover how you can create a fully automated accounts payable process using frevvo’s invoice approval software.

Click the links below to jump straight to the section you want to learn more about:

- What Is Automated Invoice Processing?

- How Automated Invoice Processing Improves Invoice Management

- 3 Steps to Implement an Automated Invoice Processing Solution

What Is Automated Invoice Processing?

Automated invoice processing is the use of software to process invoices for accounts payable and update the information in your Enterprise Resource Planning (ERP) system. It helps you speed up invoice approvals, minimize errors, and reduce processing costs.

Paying an invoice isn’t as simple as writing a check.

Prefer to see and hear it rather than read about it?

Let us show you how easy it is.

Accounts payable is a prime target for scammers who may set up shell companies and send invoices that appear legitimate — a billing scheme that cost Google and Facebook more than $100 million. These schemes can have devastating financial impacts on any company.

In order to prevent instances of fraud (and maintain accurate records), the accounts payable process typically involves the following steps:

- Matching invoices against a purchase order (PO)

- Resolving any irregularities (e.g., mismatched PO numbers, incorrect line items, etc.)

- Routing invoices to a manager or senior executive for approval

- Updating the company’s ERP system

- Issuing payments to vendors

These steps are fairly standard practices. But when they’re performed manually, AP departments are unable to maintain an efficient invoicing process. This results in lengthy approval times and higher processing costs.

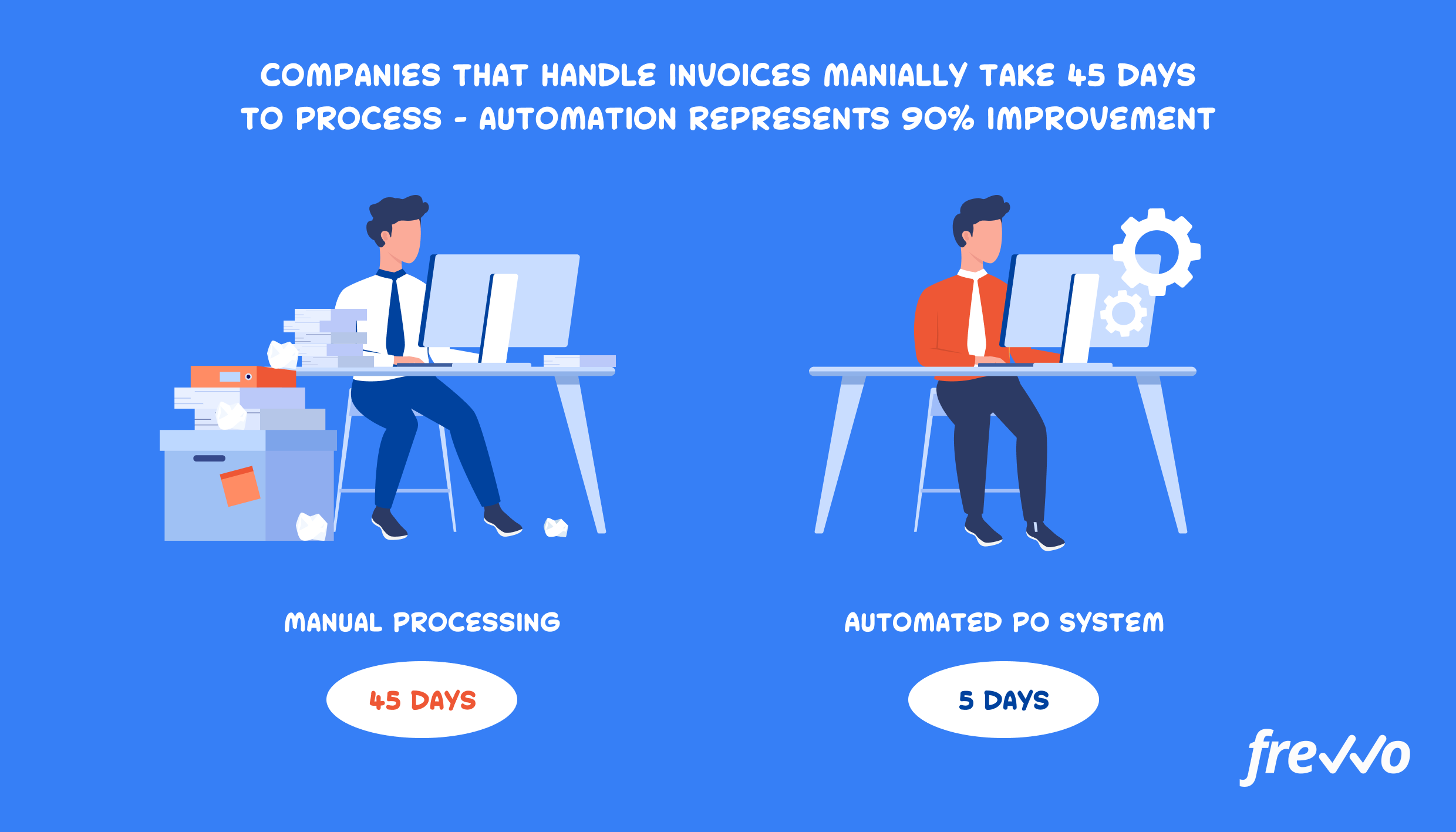

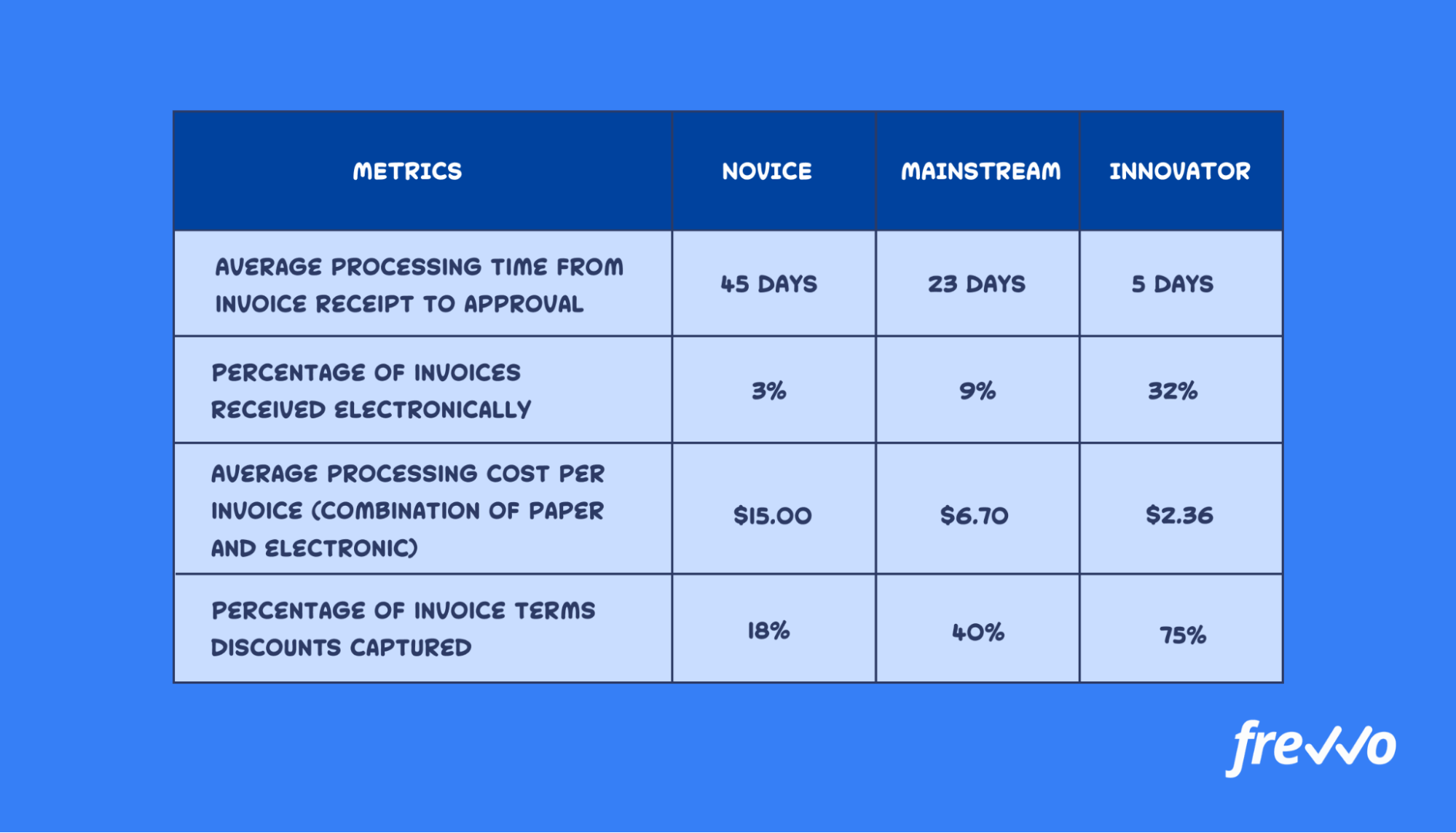

Companies that rely on manual methods take 45 days to process an invoice, while companies with automated workflows take just five days — an improvement of nearly 90%.

In addition, companies with manual processes spend an average of $15 to process an invoice, while those that use tools like business process automation software spend just $2.36.

In short, relying on manual methods to process invoices is only costing your company valuable time and money. Those costs can add up as you start working with more vendors.

Let’s look at how invoice automation can be a complete game-changer for your AP department in the next section.

How Automated Invoice Processing Improves Invoice Management

Even if your company is only handling a few invoices a month, implementing an automated invoice processing solution now can help support business growth in the future.

Here’s how frevvo’s invoice approval software helps you streamline the entire accounts payable process (without compromising on accuracy).

Reduce Manual Data Entry

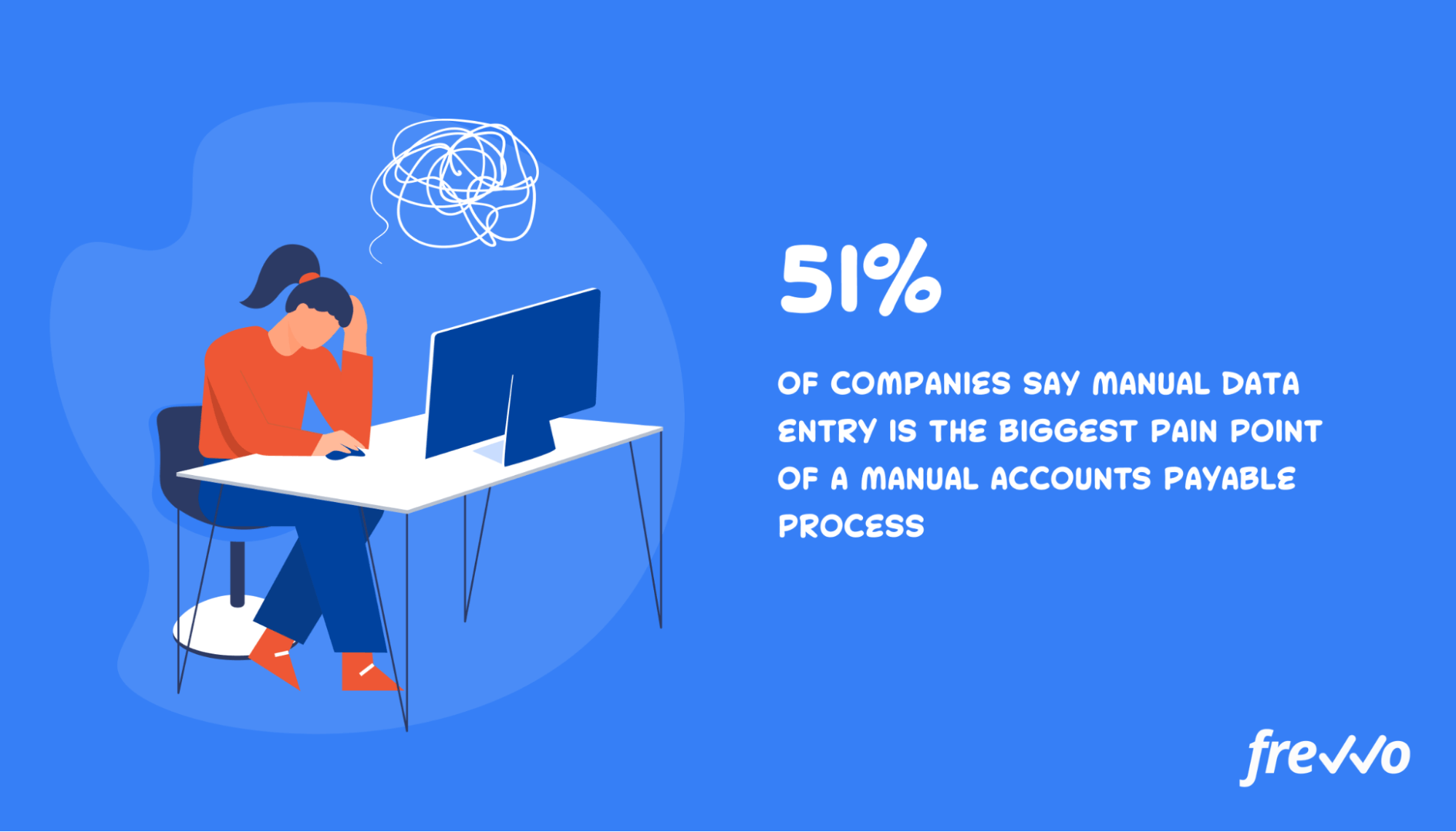

A common step in the AP approval process is keying information on approved invoices into an ERP system. Not only is this time-consuming, but it also increases the risk of errors like duplicate entries and miscalculations.

51% of companies say that manual data entry and inefficient processes are the biggest pain points of a manual AP process.

With frevvo’s invoice approval software, you can create dynamic forms that automatically populate your ERP system. This cuts down on manual data entry and minimizes errors.

Perform Invoice Matching Automatically

Accounts payable fraud is on the rise. In 2020, an estimated 74% of organizations were targets of payment scams and other billing schemes.

Invoice matching can help prevent instances of AP fraud. It involves matching incoming invoices against a corresponding purchase.

However, for companies with manual processes, a clerk would have to search for a PO in a database or worse, in a file cabinet, and match individual line items on an invoice — a process that can take hours.

An invoice approval workflow that integrates with your accounting system can perform this matching automatically and even flag any discrepancies for further review.

Route Invoices to the Right Approvers

Once the AP department has reviewed an invoice and resolved any exceptions, they’ll need to route it to a manager for approval.

However, manually routing documents can lead to further delays and even lost invoices. That’s why 37% of companies say that manual invoice routing is their biggest pain point when processing invoices.

With invoice approval software like frevvo, you can create an automated workflow that routes invoices to the right approvers and set up notifications so that they can act on it right away.

Notifications enable managers to review and approve invoices in a timely manner.

Centralize Your Records

An electronic document management system (EDMS) lets you centralize your documents, making it easy to find the files you need.

With frevvo’s built-in connectors, you can store approved invoices into systems like Google Drive, Microsoft SharePoint, Ricoh DocuWare, Xerox DocuShare, M-Files, and more.

Measure Performance

A more efficient invoice approval process will allow you to lower processing costs and even take advantage of early payment discounts.

A common discount that vendors offer is 2/10 net 30. Invoices with these terms are due within 30 days, but you can get a 2% discount if you pay them within 10 days.

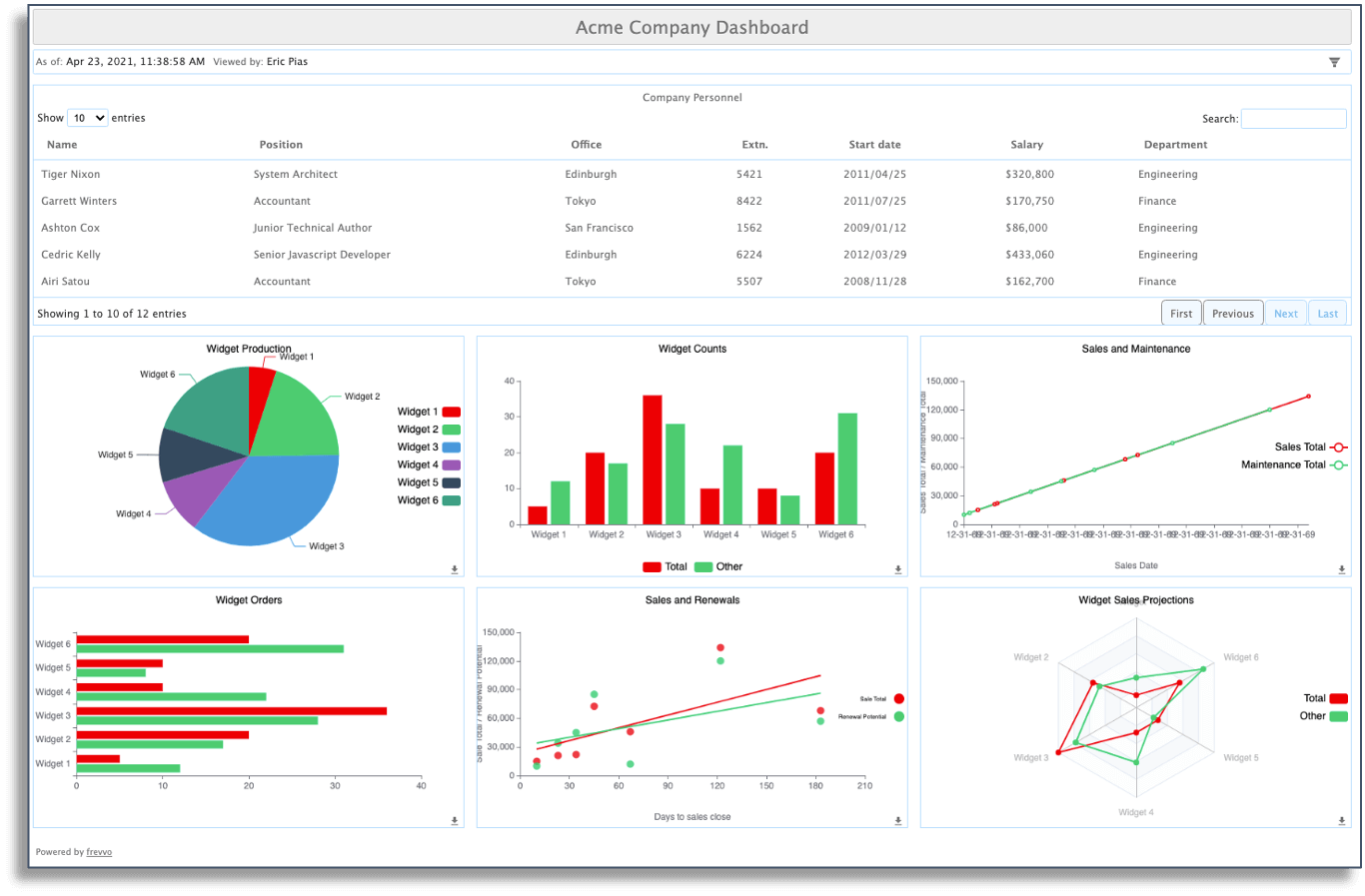

frevvo’s built-in dashboards allow you to track key metrics across your workflows in real-time, so you can identify any bottlenecks that are slowing down approvals.

Addressing any inefficiencies can help you speed up approvals and capture early payment discounts.

3 Steps to Implement an Automated Invoice Processing Solution

As we’ve seen, automated invoicing offers clear benefits. It helps you automate repetitive tasks, streamline approvals, and maintain accurate records.

With automation software from frevvo, you can set up automated invoicing workflows in a matter of days. There’s no need to hire a team of developers or allocate a huge budget on a custom AP automation solution.

Follow these steps to get started.

1. Start With a Pre-Built Template or Create Your Own Form

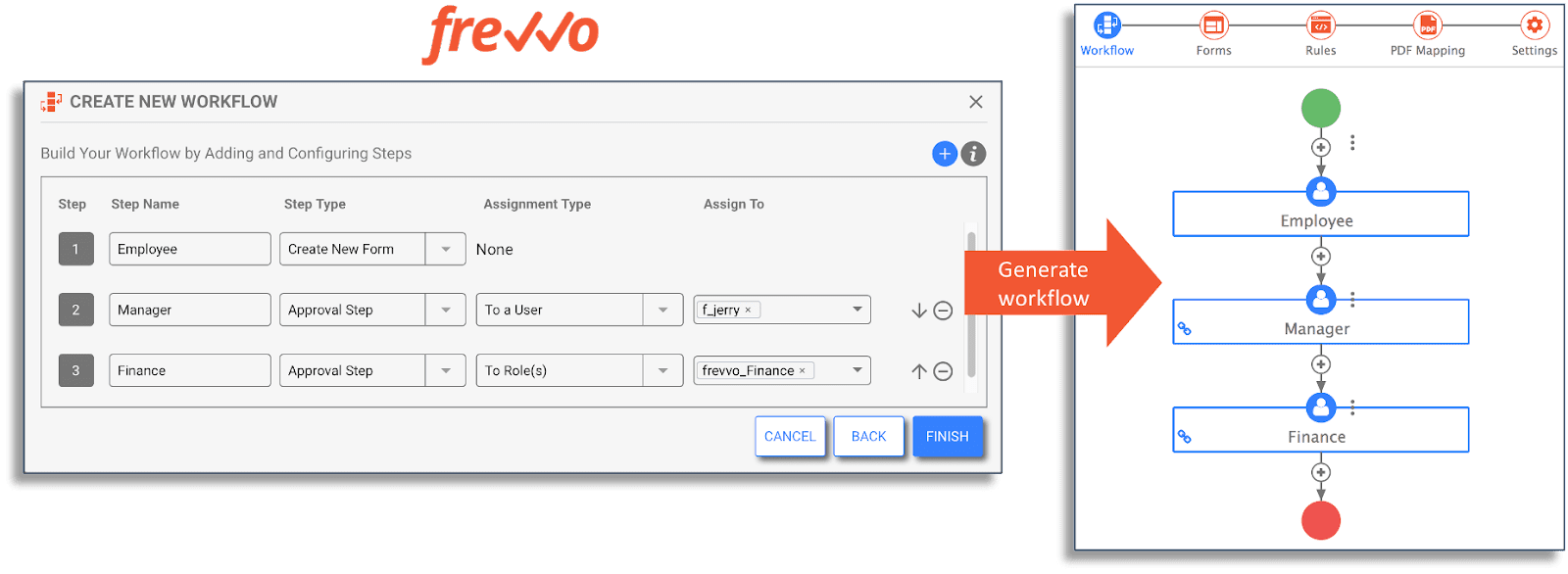

Kickstart your automation efforts by installing a pre-built invoice approval workflow. Or, you can use the workflow wizard to answer a few simple questions. Either way, the software will generate a functional workflow with routing and business rules.

The system will also create a digital form that you can use right away. Of course, you can also use the drag-and-drop form designer to customize it to fit your business needs, e.g. add an invoice line items table, create dropdown lists, enable digital signatures, and more.

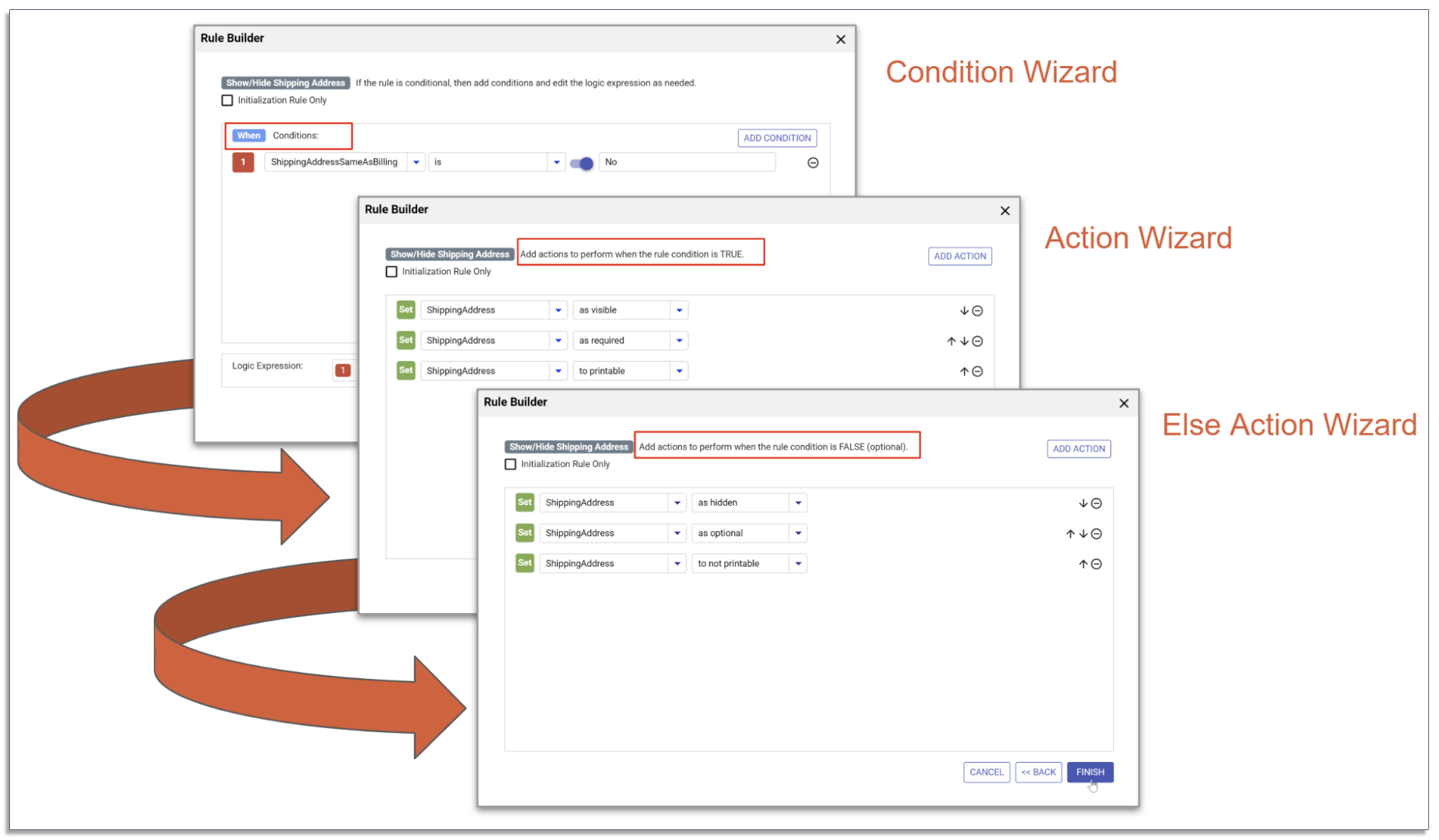

With the Visual Rule Builder, you can also add dynamic behaviors to electronic invoices. For example, you can set up your forms to only show certain information to stakeholders as the form moves through the approval process.

Even non-technical users can use the rule builder without any coding experience.

2. Customize Your Invoice Approval Workflow

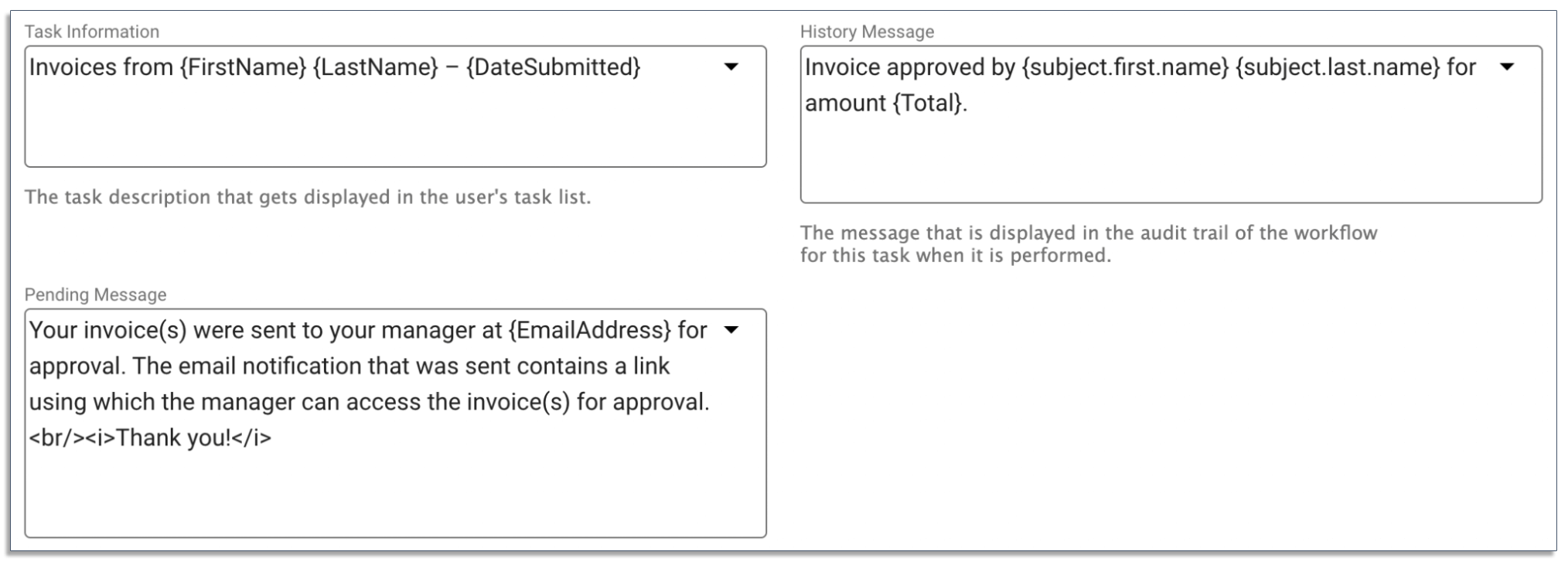

Invoices typically go through multiple approvers. Once your forms are in place, the next step is to customize your workflows to route invoices from one approver to the next.

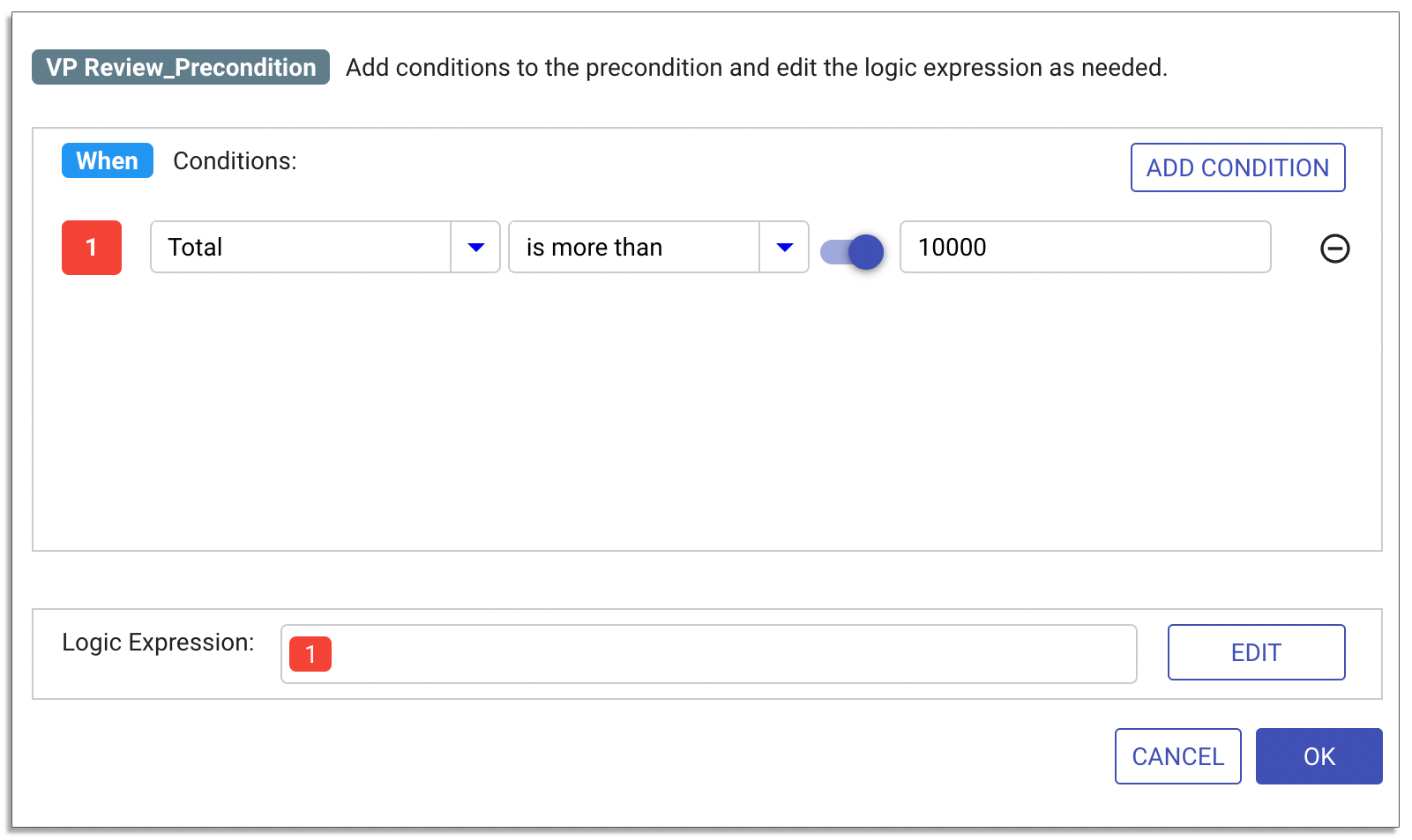

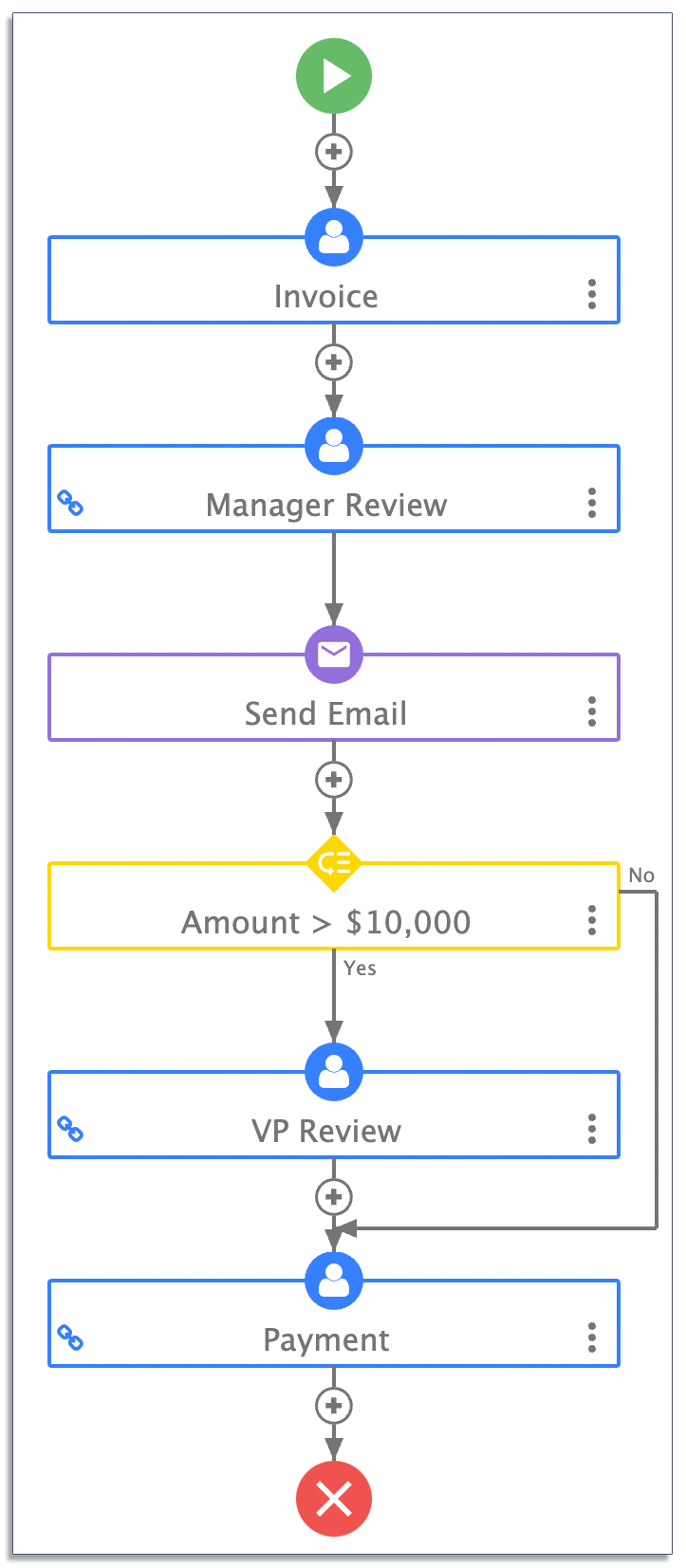

Like with the form designer, the workflow builder is fully visual, and you can use the code-free interface to apply conditional rules to your workflows. For example, you can add logic that automatically routes invoices to a senior executive if it exceeds a certain value.

Here’s an example of an invoice approval workflow with conditional routing:

Having a senior executive review every invoice isn’t often the best use of their time and could lead to delays. Conditional logic can help make your workflows more efficient and enforce compliance with internal policies.

3. Integrate With Your Accounting System

Most companies use an ERP system to manage their financial accounts. However, manually entering line items from approved invoices into these systems is tedious and time-consuming.

frevvo’s invoice automation software enables you to integrate your invoice approval workflows into your ERP system and ensure your records are up to date. Integrations help streamline approvals and cut down on manual data entry.

Once everything is set up, go through some user acceptance testing and iterate your workflows before deploying them across your organization.

frevvo’s analytics dashboards let you track key performance indicators (KPIs) so that you can analyze and optimize your workflows to improve their efficiency.

Start Automating Invoice Approvals Today

Accounts payable plays a crucial function in every organization — you need to pay your financial obligations on time to maintain good relationships with your vendors.

However, manual invoice processing is inefficient and prone to errors, putting your company at risk of lost invoices, missed payments, and even payments fraud.

frevvo’s invoice approval software makes it easy to set up automated workflows that integrate with your accounting systems. You get enterprise-grade software with hardened security, digital signature support, audit trails, and more at an affordable cost.

Get started with a 30-day free trial to see how easy it is to create automated invoice processing workflows for your company.